Communiqué 52: Canal+ has bet its future on Africa, what could go wrong?

Canal+, the French media conglomerate, is banking on Africa for growth, but can the continent shoulder the weight of its ambitions?

Presented by

1. Betting big

On December 16, 2024, French media conglomerate Canal+ debuted on the London Stock Exchange, completing its spinoff from its parent company, Vivendi. The move was part of a larger plan to see Vivendi, the corporation with stakes in advertising agency Havas and book publisher Louis Hachette, increase the valuation of its subsidiaries by spinning them off as individual entities.

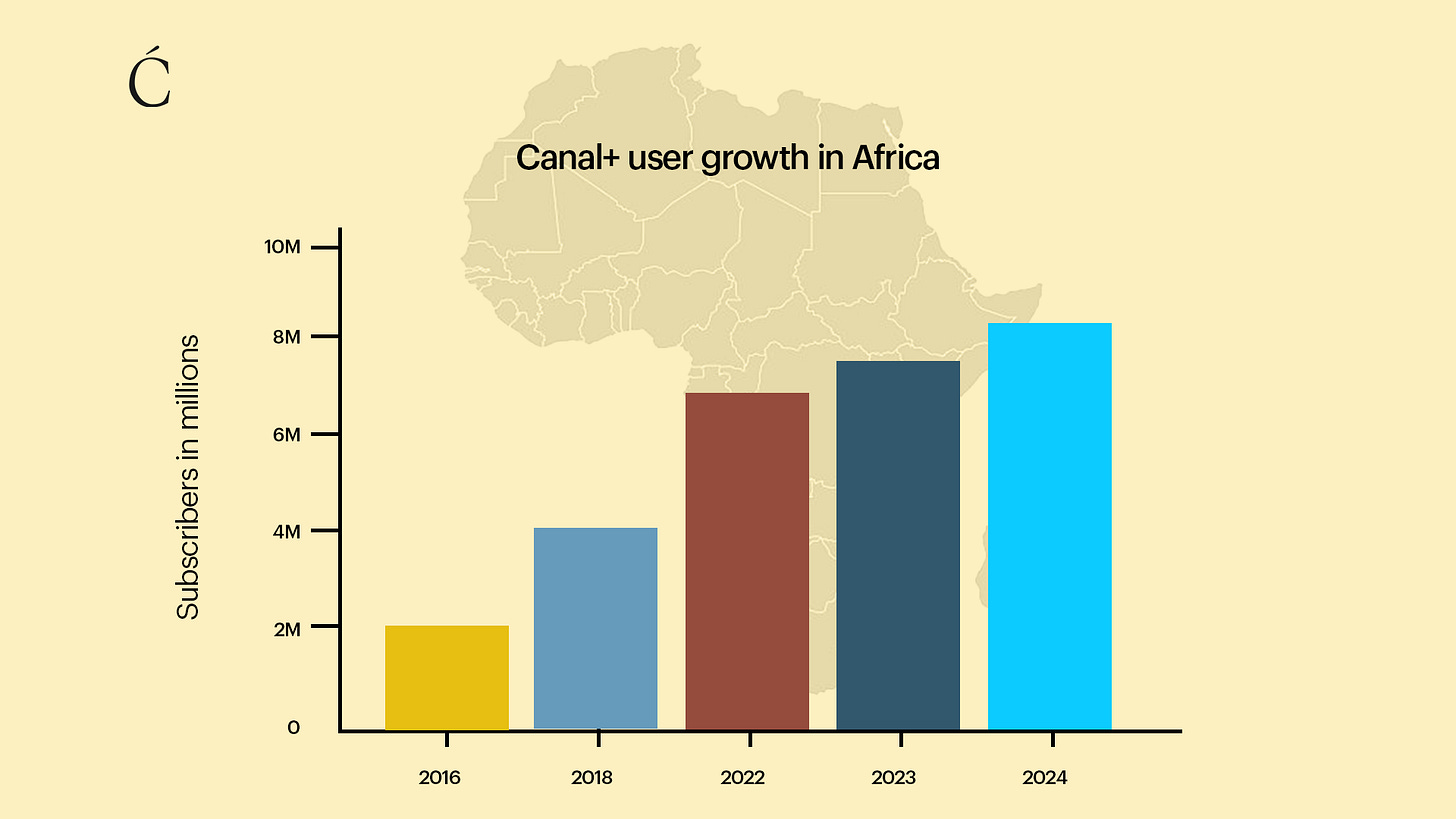

That Canal+ listed in London rather than in its home market of France was telling; it signaled a movement away from its origins as a French broadcaster to becoming a more significant global player. While France still made up 60% of its revenues, Canal+ had been aggressively expanding in other European markets, launching its Canal+ streaming service in Austria and the Czech Republic, and investing in the Swedish streaming service Viaplay Group and Hong Kong streamer Viu. But fewer things have signaled its international ambitions more clearly than its investments in Africa, where its subscribers have nearly doubled in the last six years.

Despite being the largest flotation on the London Stock Exchange in over two years, Canal+’s listing flopped, ending the first day of trading with a valuation of £2.3 billion, a 22% drop from the £6-8 billion Vivendi and JP Morgan had projected. The poor showing was attributed to some factors, including the listing being in the holiday season, but meeting that valuation will, to a large extent, depend on its investments, which have been mainly focused on Africa in recent years meeting growth expectations.

Canal+ launched in Africa in 1990 with its first station, Canal+ Horizons, six years after its parent company launched in France. For its first two decades of existence in Africa, Canal+ existed mostly as a luxury product catering to Francophone Africa.

However, in the mid-2010s, with stiff competition for the broadcast rights to sporting competitions from rivals like BeIN Sports and the rise of streaming services like Amazon and Netflix, Canal+’s growth in France began to slow down considerably. Between 2013 and 2018, it lost 1.3 million subscribers in mainland France. The broadcaster's woes were further compounded when it lost the streaming rights to the French football league for the 2020-2024 seasons to MediaPro and BeIN Sports.

Meanwhile, during the same period, Canal+ had added twice the same number of subscribers in Africa. The writing on the wall was clear: Canal+’s next phase of growth was going to come from the continent, and the company began an aggressive expansion drive.

2. Growth by acquisition

Canal+ has adopted an acquisition strategy as its main growth driver across Africa. In 2019, it acquired IROKOtv’s ROK film studio. The deal included Rok’s production, content distribution, and publishing channels, and introduced Canal+ as a player in Nigeria’s film industry. Similar deals followed with Rwanda’s Zacu Entertainment, Senegal’s Marodi TV, and Mauritania's MC Vision.

By acquiring already successful African media companies rather than starting operations from scratch, Canal+ built upon the strengths of these local players to accelerate market entry and navigate complex regulatory and cultural systems. Also, Canal+ typically made little to no adjustment to the brand identity and operations of these companies post-acquisition, thereby minimizing disruptions to viewers and maintaining brand and loyalty.

Furthermore, acquiring established media companies meant Canal+ could access ready-made audiences, operational infrastructure, and local market knowledge. These acquisitions reduced the risks and costs associated with starting new ventures in unfamiliar markets. Established companies already possess valuable assets such as broadcasting licenses, distribution networks, and strong relationships with advertisers, which Canal+ then integrated into its operations.

3. A Multi single choice for African domination

For much of its existence, Canal+ had focused its operations in Francophone Africa, where it was the dominant pay TV provider, leaving Anglophone Africa to MultiChoice in what could be likened to a gentleman's agreement. But in April 2020, Canal+ breached that agreement and began to silently acquire shares in MultiChoice. By October 2020, Canal+ had gathered more than 5% of MultiChoice shares, the point at which it was legally required to publicly disclose ownership of those shares.

But Canal+ did not stop there, it continued to acquire shares in its Anglophone counterpart, sparking fears of a hostile takeover. These fears were not unfounded; Vivendi, Canal+’s parent company, had adopted a similar approach of buying up company shares before executing a hostile takeover of video game maker Gameloft.

MultiChoice, however, had South African regulators on its side. While a foreign entity can own a significant percentage of a South African broadcaster, its voting rights are limited to 20%. However, this did not stop Canal+. It continued to acquire MultiChoice shares, bringing on South Africa’s richest man and CAF president, Patrice Motsepe, into its bid to help bypass the South African requirement for local ownership.

By February 2024, Canal+'s ownership of MultiChoice had risen to the 35% limit where it was required by law to make a formal acquisition offer. After an initial offer from Canal+ valuing MultiChoice at $2.3 billion was rejected, the French company came back with a new offer, this time valuing MultiChoice at $2.9 billion. MultiChoice accepted this offer in June 2024, and the deal is currently awaiting regulatory approval. By this time, Canal+'s shares in MultiChoice had risen to 45.2%.

When the acquisition is completed sometime this year, Canal+ will become the largest pay TV provider on the continent, creating a broadcast monopoly with over 30 million subscribers.

4. Local content, global ambitions

With growing competition from Chinese broadcaster StarTimes, Canal+ began to reverse its approach to programming on the continent in the mid-2010s. It started focusing on producing and distributing more African content instead of importing French TV programs to cater to expatriates and wealthy Africans, who made up a large percentage of its customer base. In 2014, Canal+ launched A+, its first fully Africa-focused station, in Abidjan. In 2018, production began for The Invisibles, Canal+'s first original African series.

“Africans want us to address them directly and not offer them programs that reference things they don’t know, just because that’s what’s shown in Paris. The African public wants things made by them, for them, and, if possible, on-site,” Canal+ International's Chief Content Officer Fabrice Faux told Reuters at the time.

In its push to become the major broadcaster in Africa, Canal+ has doubled down on content localization. A strategy that combines local content production, market-specific programming, and cultural adaptation to drive subscriber growth and market penetration. This approach enables the company to create and distribute programs in local languages and dialects that resonate deeply with African audiences.

This localization strategy extends beyond just content creation. Canal+ has developed market-specific channels that cater to local viewing preferences and habits. For example, it has launched dedicated channels for different regions that combine local productions with international content dubbed or subtitled in local languages. Following the acquisition of Zacu Entertainment in Rwanda in July 2022, Canal+ launched Zacu TV, its first channel offering programming in Kinyarwanda, Rwanda’s official language.

Also, Canal+ has secured the broadcast rights to both international and local sporting competitions like the African Cup of Nations in the markets where it operates.

To support this approach of content localization, Canal+ has invested in local talent development through training programs. In 2019, Canal+ International launched Canal+ University, an itinerant training center in African cities, to provide training to audiovisual actors. This approach helps build sustainable local content ecosystems while ensuring a pipeline of talent.

5. An African gamble

Canal+ seems to have all its bases covered in its quest for African domination, but some concerns remain, of which the most pressing is the MultiChoice question. Will MultiChoice sell off its whole business to Canal+, or will it spin off its streaming subsidiary, Showmax, while selling its broadcast TV business? Any deal that sees Canal+ acquire MultiChoice without Showmax would still leave Canal+ defenseless against the same streaming wave that affected its business in its home country.

However, the long-term concern is whether Africa, with its economic challenges, is fit to carry the weight of Canal+’s ambitions. Despite multiple price increases over the last two years, MultiChoice has still seen a decline in its revenue from Nigeria as the country struggles with currency devaluation. These economic challenges have also pushed players like Prime Video out of the market and led others like Netflix to rethink their strategy.

Additionally, pay TV is still a luxury for millions on the continent, competing with basic needs like food and shelter. Canal+ staking a huge part of its future growth plans on Africa might just be asking too much from the continent. Individually, the bets could be considered precarious. But collectively, these bets have made the French company Africa’s most consequential media player.

Very interesting and comprehensive article. It would be interesting to see how African media (particularly Nollywood) evolves with the involvement of Canal +.